Summary

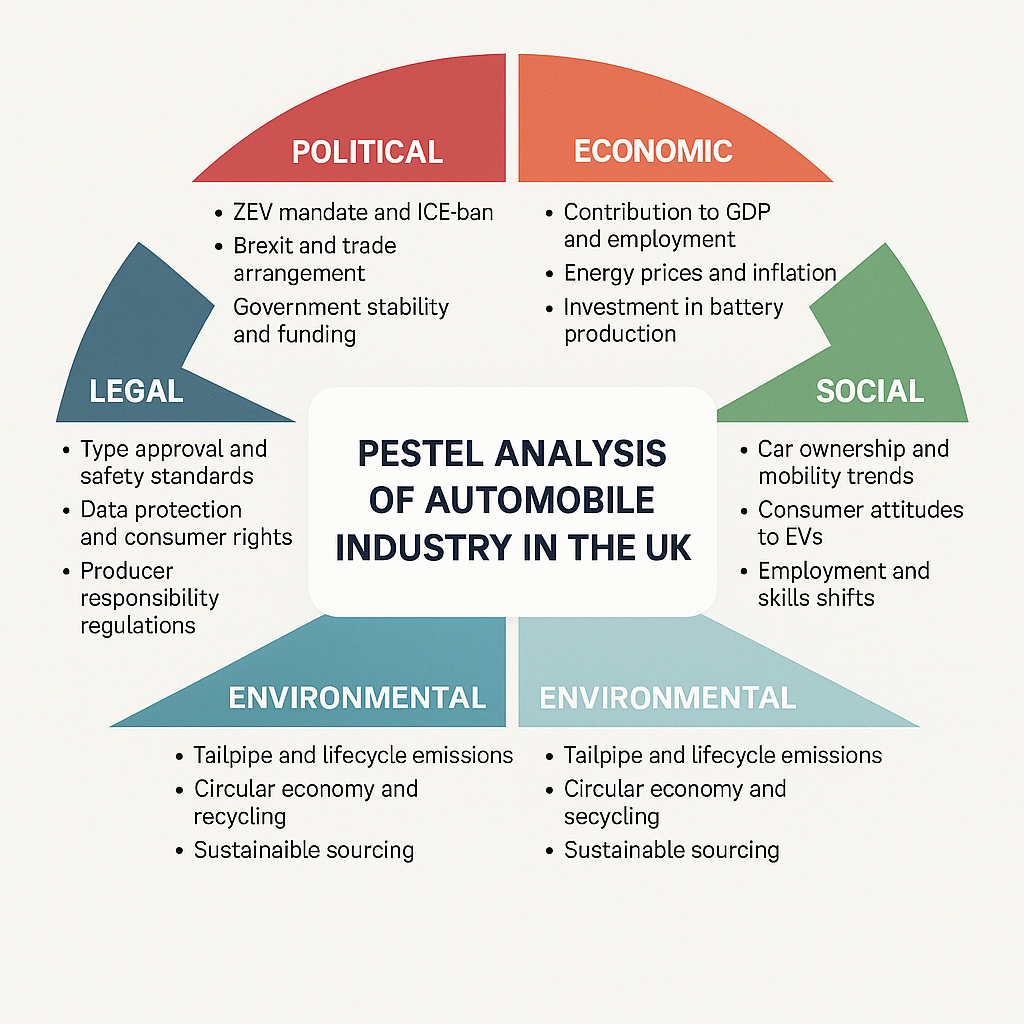

The UK automobile industry operates in a complex environment shaped by political, economic, social, technological, environmental, and legal dynamics. Government policies and industrial strategies drive the transition to electric mobility, while trade arrangements and Brexit-related rules create both risks and opportunities. Economically, the industry remains a major contributor to jobs and exports but faces cost pressures from energy prices, inflation, and investment needs in gigafactories and supply chains. Socially, affordability, inclusivity, and equitable access to charging are critical to ensure adoption across diverse communities while protecting employment in a shifting skills landscape. Technological progress in batteries, power electronics, software-defined vehicles, and automation is redefining competitiveness, though commercialization speed and cybersecurity remain challenges. Environmentally, electrification cuts tailpipe emissions but increases the importance of sustainable materials, clean energy, and circular economy practices. Legally, firms must comply with strict type-approval, product safety, data protection, consumer protection, producer-responsibility, and emerging automated-vehicle frameworks.

Political Analysis of the UK Automobile Industry

Executive Overview

The automobile industry in the United Kingdom is undergoing profound change, shaped by political decisions at both the domestic and international levels. The transition to electric vehicles (EVs), industrial strategy reforms, Brexit-related trade rules, and energy policy are central to its current trajectory. This analysis explores how political forces affect competitiveness, investment, and long-term sustainability of the sector.

1. Government Policy and Strategic Direction

The UK government has made decarbonization of transport a cornerstone of its climate agenda. The introduction of a Zero Emission Vehicle (ZEV) mandate compels automakers to meet rising quotas for EV sales, leading to a phase-out of new petrol and diesel cars by 2035. Simultaneously, the revival of an industrial strategy emphasizes advanced manufacturing, clean energy, and the establishment of gigafactories to secure domestic battery production.

Implication: Political commitment ensures a clear roadmap, but also imposes significant compliance costs on manufacturers during a period of weak consumer demand for EVs.

2. Regulatory Environment

Regulation is reshaping the market landscape. The ZEV mandate sets strict sales targets, enforced through a credit system. Building regulations now require chargepoints in new developments, and rules are in place to standardize user experience at charging stations. However, the government has withdrawn direct consumer subsidies for new EV purchases, shifting the focus toward supply-side obligations and infrastructure investment.

Implication: A supply-heavy approach may widen the gap between production targets and consumer adoption unless charging infrastructure and affordability improve.

3. Trade and Brexit Considerations

The UK’s departure from the European Union has added complexity to automotive trade. Rules of origin requirements for EVs and batteries were initially set to impose tariffs on non-localized content, but transitional arrangements have temporarily eased this pressure. Nonetheless, the long-term challenge remains: without strong domestic battery supply chains, UK-built vehicles risk losing competitiveness in EU markets.

Implication: Trade agreements and battery localization are now political and economic priorities. Failure to scale domestic production could weaken the UK’s automotive exports.

4. Energy and Infrastructure Politics

High industrial energy costs have long placed UK manufacturers at a disadvantage. Recent government promises to reduce electricity costs for energy-intensive sectors aim to restore competitiveness. At the same time, delays in grid upgrades and regional disparities in charging infrastructure have turned EV adoption into a regional political issue, with some areas far behind others.

Implication: Success depends not only on headline targets but also on resolving local infrastructure challenges that directly influence consumer trust and adoption rates.

5. Market Dynamics and Industrial Capacity

UK car production has declined in recent years due to plant retooling, supply chain disruptions, and subdued global demand. While gradual recovery is expected, volumes are unlikely to reach past peaks soon. Meanwhile, consumer EV uptake lags behind regulatory expectations, creating risks of non-compliance and forcing manufacturers to adjust product portfolios and sales strategies.

Implication: The industry faces a fragile balancing act between meeting regulatory targets and sustaining profitability during a period of structural transition.

6. International Context

The UK must remain aligned with international partners, particularly the European Union. The EU is currently reviewing its own 2035 CO₂ regulations, and any divergence could create complications for cross-border trade. Alignment ensures smoother exports and avoids a regulatory mismatch that would burden automakers with duplicate compliance frameworks.

Implication: Political coordination with the EU is essential for maintaining competitive market access and preventing unnecessary trade barriers.

7. Key Risks and Challenges

- Mandate–Market Gap: EV sales targets may outpace consumer demand.

- Battery Supply Chain Vulnerability: Domestic gigafactory delays could lead to tariff exposure.

- Energy Competitiveness: High costs could deter investment if promised reforms are slow.

- Infrastructure Gaps: Regional disparities in charging threaten consumer confidence.

- Policy Misalignment: Divergence from EU rules could disrupt trade flows.

8. Strategic Path Forward

- For Policymakers: Provide consistent regulatory timelines, accelerate grid reforms, and consider targeted incentives to stimulate demand without distorting markets.

- For Industry: Prioritize affordable EV models, deepen EU-UK battery supply chains, and collaborate with local authorities to expand charging access.

- For Trade Strategy: Strengthen partnerships with global suppliers of critical minerals and align closely with EU automotive standards.

Economic Analysis of the UK Automobile Industry

Executive overview

The UK auto industry is a high-multiplier, export-oriented ecosystem spanning OEMs (cars, vans, specialist vehicles), Tier-1/2 suppliers, logistics, retail, finance, aftersales, and recycling. Over the next 3–7 years, sector economics hinge on four forces: (1) the speed and cost of electrification, (2) energy prices and grid capacity, (3) trade access and rules of origin for EVs/batteries, and (4) consumer demand elasticity amid tighter household budgets. Profit pools are shifting from combustion powertrains to software, batteries, and services; firms that localize key components and manage working capital tightly will defend margins best.

1) Industry structure and value creation

- Value chain: upstream materials (steel, aluminium, polymers, cathode/anode materials), cell/gigafactories, pack/thermal systems, e-powertrain and electronics, body-in-white/paint, final assembly, distribution/finance, aftersales and circular flows (remanufacture, second-life batteries, recycling).

- Concentration: assembly is relatively concentrated (few anchor plants), while supply is fragmented (many SMEs). Market power resides with OEMs on product spec, and with a handful of Tier-1s on safety-critical systems and battery modules.

- Profit pools: historically highest in premium ICE models and captive finance; shifting toward EV platforms, ADAS/software options, fleet subscriptions, and lifecycle energy services (home/public charging partnerships, V2G).

Implication: Economies of scale in platforms and batteries are decisive; smaller volumes must be offset by higher pricing power, flexible manufacturing, or niche/specialist positioning.

2) Demand fundamentals

- Drivers of new-vehicle demand: disposable income, consumer credit availability and APRs, fuel/electricity prices (TCO), company-car tax rules, urban clean-air policies, and charging availability. Fleet channels (business leasing, rental, delivery) typically lead EV adoption due to lower TCO and predictable duty cycles.

- Price elasticity: retail buyers of mass-market models show higher price sensitivity than premium buyers. Subsidy removal or higher finance rates quickly depresses retail EV demand unless offset by discounts, used-EV residual support, or low-cost models.

- Substitution and used market: a large, liquid used-car market dampens new-car cyclicality but can amplify swings in residual values (RVs), which feed back into lease rates and monthly payments.

Implication: To maintain volumes without margin erosion, OEMs lean into fleets, captive finance offers, and trim rationalization; retailers emphasize used-EV warranties and battery-health transparency to protect RVs.

3) Supply-side economics: cost stack and productivity

Typical vehicle cost components (illustrative shares vary by segment):

- Materials & components (45–60%): for EVs, battery cells/modules are the single biggest line item; for ICE, engine/exhaust aftertreatment matters most.

- Labour (8–15%): concentrated in assembly and high-skill engineering; efficiency depends on plant utilization and automation.

- Overheads (5–10%): plant, logistics, quality, compliance.

- R&D and tooling amortization (5–10%): spread over platform lifecycles; lower volumes raise unit amortization.

- Energy (2–6%): electricity and gas for press shops, paint, ovens; meaningful for competitiveness—especially in paint and gigafactories.

Implication: Two levers dominate unit economics: (a) utilization (through stable volumes and mixed-model lines) and (b) localizing heavy components (battery/castings) to cut logistics and meet trade rules.

4) Trade, exchange rates, and rules of origin

- Exchange-rate pass-through: a weaker pound can boost export price competitiveness but raises the sterling cost of imported parts and materials. Hedging smooths near-term swings but cannot erase structural trends.

- Rules of origin (RoO): to avoid tariffs on UK-EU vehicle trade, a growing share of value—especially battery content—must be “local.” This nudges investment into domestic or nearby (European) cell, cathode, and pack capacity.

- Logistics: just-in-time supply increases sensitivity to border friction; working-capital buffers (inventory) rise when lead times lengthen.

Implication: Local battery and component content is becoming not only a cost play but a market-access necessity.

5) Energy prices, grid capacity, and location economics

- Industrial power costs: high electricity prices compress margins in energy-intensive steps (stamping, paint, cells). Multi-year PPAs, on-site renewables, and demand-response contracts can partially de-risk.

- Grid connections: new loads (fast chargers, gigafactories) require timely connections; delays force diesel backup or battery buffers, raising capex/opex.

- Regional clusters: plants co-locate with suppliers, ports, and universities; policy incentives and land availability shape future gigafactory siting.

Implication: Plants that secure competitive long-term power and timely grid access will command new model allocations and supplier co-investment.

6) EV transition economics

- Battery learning curves: every doubling of cumulative battery output historically lowers $/kWh, but chemistry choices (LFP vs NMC vs LMFP), commodity cycles (lithium, nickel), and yield rates drive variability.

- Scale breakpoints: below certain volumes, EV platforms struggle to absorb R&D/tooling; shared skateboard architectures and common modules (motors, inverters) are vital.

- Charging ecosystem: TCO parity depends on energy tariffs and charging convenience. Public charging costs and queuing risk shift buyers toward PHEVs or efficient ICE if infrastructure lags.

- Residual values: uncertainty on battery health depresses RVs; OEM-backed warranties, certified diagnostics, and guaranteed buybacks can stabilize finance offers.

Implication: The winning formula pairs affordable small/mid EVs with low-rate financing, robust used-EV channels, and visible charging coverage.

7) Labour markets, skills, and automation

- Skills shift: demand moves from ICE machining to high-voltage safety, electronics, software, BMS, and cell quality. Retraining costs rise but can boost productivity if paired with automation.

- Wage dynamics: tight labour markets push up wages in tech roles; meanwhile, automation (press, paint, battery lines) raises capex but lowers per-unit labour cost at high utilization.

Implication: Strategic partnerships with colleges and targeted upskilling programs are as critical to capacity as physical plant upgrades.

8) Financing, working capital, and profitability anatomy

- Operating margin drivers: mix (premium vs mass), incentive spend, currency, energy, and warranty accruals.

- Working capital: battery and semiconductor inventories tie up cash; supplier payment terms and consignment stock can ease strain.

- Retail finance: captive finance earnings (interest, insurance, GAP, service plans) cushion thin manufacturing margins. Rising rates pressure approvals and increase monthly payments; risk management focuses on credit scoring and RV forecasting.

Implication: Balance-sheet strength matters: firms with cheaper capital can fund model cycles and carry inventory through shocks.

9) Environmental externalities and circular economy

- External costs: local air quality, CO₂, noise, congestion. Policy internalizes some costs via mandates and urban access rules.

- Circular opportunities: end-of-life battery recycling (lithium, nickel, cobalt), second-life stationary storage, remanufacturing of e-motors and inverters. Capturing these loops reduces commodity exposure and creates new revenue.

Implication: Early movers in recycling and second-life services reduce raw-material risk and may monetize compliance credits where applicable.

10) Segment economics and pricing power

- Premium vs mass market: premium brands enjoy higher contribution margins, faster software take-rate, and stronger RVs; mass market relies on scale and cost discipline.

- LCV (van) segment: fleet-heavy, TCO-driven; electrification depends on duty cycles, depot charging, and payload/range requirements.

- Niche/specialist vehicles: lower volumes but high margins; export exposure is high, so RoO and FX are pivotal.

Implication: Expect stronger profitability resilience in premium and LCV fleets, with more volatility in entry mass-market EVs.

11) Scenario outlook (2026–2030)

Base case

- Gradual EV share growth led by fleets; retail improves as more affordable small EVs arrive.

- One or more large-scale battery plants operational or in late ramp; supplier localization deepens.

- Energy prices trend lower on long-term contracts; grid bottlenecks ease gradually.

- Margins stable to slightly higher on improved utilization; capex elevated but peaking mid-period.

Upside case

- Rapid cost declines in LFP/LMFP cells and strong pound for imported materials.

- Accelerated charger rollout and lower public-charging tariffs; used-EV RVs stabilize.

- Higher volumes enable price normalization and lower incentive spend; free cash flow strengthens.

Downside case

- Delays to battery localization trigger tariff exposure; sterling weakness lifts parts costs.

- Public charging remains patchy; retail demand underwhelms, fleet discounts widen.

- Energy prices remain high; model allocations shift away from UK plants, compressing utilization.

12) Key performance indicators (KPI dashboard)

Track these internally (monthly/quarterly) to manage the business and assess industry health:

Demand & channel

- Order intake vs production; fleet vs retail mix

- Average APR, approval rates, and average monthly payment

- Used-EV residual values (by segment/age), days-to-turn

Cost & efficiency

- Battery pack cost (£/kWh) landed; yield rates (%)

- Plant OEE and utilization (%), scrap/rework rates

- Energy intensity (kWh/vehicle) and blended electricity price (p/kWh)

Supply & trade

- Local content (%) vs RoO thresholds

- Supplier OTIF (%), inbound lead times (days), inventory turns

- FX exposure (GBP/EUR, GBP/USD) and hedge coverage (%)

Profitability & cash

- Contribution margin per unit (£), incentive spend per unit (£)

- Free cash flow conversion (%), capex/sales (%)

- Warranty claims (per 1,000 vehicles), battery-health claim rate

13) Strategic recommendations

For manufacturers (OEMs)

- Localize batteries and heavy components to de-risk tariffs and logistics; pursue JV or tolling models if capex is constrained.

- Standardize platforms and modules to scale across segments; prioritize small/mid EVs with fleet-ready specs.

- Strengthen captive finance with RV guarantees and battery-health diagnostics to unlock retail affordability.

- Energy strategy: long-term PPAs, on-site renewables, and demand flexibility to stabilize costs.

- Aftermarket & circular: certified used-EV programs, second-life battery partnerships, end-of-life recycling.

For suppliers

- Move up the stack into e-powertrain, thermal, and electronics; secure long-term nominations with platform visibility.

- Operational excellence: automation in high-mix/low-volume lines; digital quality to cut scrap.

- Financial resilience: diversify customer base; align payment terms and inventory financing.

For retailers and mobility providers

- Transparency on TCO and battery health to support consumer trust and RVs.

- Subscription/flex models for EV trials; bundled energy tariffs and home-charger offers.

- Data-driven aftersales (predictive maintenance) to stabilize margins as ICE service revenues decline.

14) Practical toolkits (plug-and-play)

A. TCO parity calculator (outline)

- Inputs: vehicle price, deposit, APR/term, fuel vs electricity tariffs, annual miles, maintenance, insurance, taxes/charges.

- Outputs: monthly payment, pence-per-mile, breakeven mileage vs ICE, sensitivity to energy prices and RVs.

B. Battery localization business case

- Compare landed pack cost (import) vs localized pack (cells + pack assembly + logistics + scrap + energy).

- Include RoO benefit (avoided tariff), working-capital impact, and model-allocation probability uplift.

C. Charger deployment ROI

- Inputs: capex per site, utilization, tariff spread vs wholesale, O&M, grid fees.

- Outputs: IRR, payback, sensitivity to utilization and power price.

Executive overview

Cars in the UK are more than products; they shape daily life, employment, mobility, identity, and the urban fabric. As the industry shifts to electrification and software-defined vehicles, the social stakes include who gains access to clean mobility, which regions win or lose jobs, how communities adapt infrastructure, and whether the transition feels fair. Success hinges on inclusive design, affordable options, and visible benefits for households beyond early adopters.

1) Stakeholder map (people and communities)

- Workers & skills: assembly workers, engineers, electronics technicians, battery specialists, dealership staff, roadside repairers, recovery drivers, valeters, and gig-economy drivers.

- Consumers: fleet buyers, company-car users, private retail buyers, low-income households, rural drivers with long commutes, young drivers facing high premiums, families with multi-car needs, disabled motorists needing adapted vehicles, and older drivers prioritizing safety and comfort.

- Places: manufacturing regions (e.g., the Midlands and the North East), port towns, university cities, and dense urban areas with low-emission or congestion zones; villages and small towns with sparse public transport.

- Civic actors: local councils, combined authorities and mayors, community energy groups, housing associations, disability advocates, unions, road-safety charities, cycling/walking groups, and neighborhood forums.

- Ecosystem partners: charge-point operators, property managers, supermarkets/retail parks, and energy suppliers.

Why this matters: Social outcomes are decided not just in factories or showrooms but at the intersection of local planning, housing, energy, and everyday travel needs.

2) Employment, identity, and “just transition”

- Jobs mix is changing. Electrification reduces ICE-specific roles (e.g., engine machining) while creating roles in batteries, electronics, and software. The social challenge is reskilling at pace—especially for mid-career workers and smaller garages.

- Regional pride and identity. Automotive heritage underpins local identity in several regions. Plant expansions or closures have outsized effects on community morale, local retail, and schools.

- A fair path. A “just transition” means retraining routes that pay during learning, childcare-compatible schedules, recognition of prior experience, and transport to new workplaces. Without this, people may perceive climate policy as a threat to livelihoods.

3) Access, affordability, and mobility equity

- Upfront vs monthly cost. Households feel affordability through deposits and monthly payments, not list price. Transparent total-cost-of-ownership and fair finance terms are social inclusion tools.

- Charging and housing. Off-street parking is a privilege; renters and residents of flats rely on public or workplace charging. Equitable rollout—on-street, community hubs, and at supermarkets—prevents “EV inequality.”

- Rural realities. Long distances, limited buses, and higher reliance on cars mean rural drivers need dependable range and charging; otherwise, the transition risks deepening regional divides.

- Disability inclusion. Accessible charging bays, kerb-free cable routes, reachability of screens and sockets, and reliable customer support are essential—not optional extras.

4) Culture, identity, and consumer trust

- Car as identity. For many, cars signal independence, status, or practicality. Acceptance of new tech depends on design appeal, interior quality, charging convenience, and confidence in residual values.

- Information asymmetry. Jargon around kWh, kilowatts, and charging rates can be alienating. Clear language, simple booking/payment, and standardized signage build trust.

- Used-car culture. The UK’s large used market is a social safety valve. Battery confidence (warranties, health certificates) is critical so second- and third-owners feel protected.

5) Health, safety, and street life

- Public health co-benefits. Quieter streets and reduced tailpipe pollution support healthier neighborhoods, but tyre/road dust and traffic volumes still affect air quality and noise.

- Road safety. Advanced driver assistance can reduce collisions if well-understood; however, driver distraction from touchscreens is a growing concern.

- Urban realm. The balance between parking, loading, cycling infrastructure, and bus priority shapes how welcoming streets feel to children, older adults, and people walking or wheeling.

6) Data, privacy, and digital inclusion

- Connected cars. Insurance pricing, telematics, over-the-air updates, and in-car apps raise questions about data ownership, consent, and cybersecurity.

- Digital exclusion. App-only access to charging or parking penalizes people without smartphones, limited data plans, or digital confidence. Inclusive design means card readers, helplines, and simple interfaces.

7) Gender and inclusion lenses

- Design defaults. Seat geometry, safety testing assumptions, and HMI choices can inadvertently prioritize male anthropometrics and habits. Diverse user testing improves safety and comfort for everyone.

- Care journeys. Trip chains that include school, work, shopping, and elder care demand flexible interiors, easy child-seat mounting, and secure boot space—features that drive real adoption.

- Personal safety. Well-lit charging areas with CCTV, visible staff presence, and safe waiting spaces matter to many drivers, especially at night.

8) Youth, licensing, and insurance

- Delayed licensing. Urban young adults may delay learning to drive due to costs, decent public transport, and ride-hail availability.

- Insurance burden. High premiums can exclude new drivers from car access altogether. Community car-clubs, pay-as-you-drive, and safe-driving telematics can broaden access without compromising safety.

9) Small businesses, trades, and gig workers

- White-van social impact. Trades rely on vans for livelihoods; range, payload, and downtime at chargers are social and economic issues. Depot charging and fair public-charging tariffs are inclusion tools for small firms.

- Gig drivers. Private-hire and delivery drivers need predictable costs and reliable charging near hotspots. Access to night-rate electricity and fair lease terms affects take-home pay and household stability.

10) Place-based charging: what “good” looks like

- Fair geography. Ensure coverage beyond affluent postcodes; target towns with limited rail links and estates with low car access history but rising need.

- Everyday locations. Co-locate chargers where people already go—supermarkets, community centers, health hubs—so charging time doubles as errand time.

- Accessible by design. Wider bays, dropped kerbs, cable management, seating, lighting, contactless payment, voice-assisted help, and clear signage.

- Community energy. Pair chargers with local renewables and visible dashboards to build pride and engagement.

11) Social KPIs to track (practical dashboard)

- Access & affordability: share of chargers in lower-income wards; proportion of renters within a 5–10-minute walk of a charger; median monthly payment for popular models; availability of flexible finance.

- Inclusion: percentage of charging sites meeting accessibility standards; night-time lighting coverage; multi-language support; card-payment availability.

- Skills & jobs: number of workers retrained into EV/battery roles; apprenticeship starts; SME garage upskilling participation.

- Community satisfaction: resident satisfaction with local charging; reported issues resolved within 72 hours; vandalism/incivility rates at charging sites.

- Safety & health: collisions per million miles for ADAS-equipped vehicles; near-miss reports at complex junctions; noise and street-level air metrics around busy corridors.

- Youth & first-time drivers: average insurance cost for 18–24s by region; uptake of car-club memberships; test-pass rates and access to lessons.

12) Personas (to design with, not for)

- Flat-dwelling renter, urban: No driveway, evening charging near home needed; values contactless pay and well-lit sites.

- Rural shift worker: Long commute at off-peak hours; needs reliable range and charger availability on A-roads.

- Disabled driver: Requires step-free access, reachable sockets, and customer support that understands adaptations.

- Trade van owner: Payload/range balance, predictable charging at depot, and minimal daytime downtime.

- Young driver on a budget: Insurance and monthly payments are make-or-break; open to car-share if convenient.

13) Risks if the social dimension is ignored

- Perceived unfairness (“EVs are only for the well-off with driveways”).

- Community opposition to charging sites or grid upgrades.

- Skills mismatch and job losses concentrated in specific towns.

- Digital exclusion at chargers and parking meters.

- Stalled adoption, undermining environmental and economic goals.

14) Practical actions

For central & local government

- Tie public charging funds to equity criteria: coverage in lower-income and rental-heavy areas; accessibility compliance; night-lighting standards.

- Fund paid reskilling with portable certifications for mechanics and electricians; support SMEs with tool grants.

- Standardize consumer information: simple tariffs, clear kW/kWh explanations, and upfront total-cost estimates.

- Integrate transport and housing: require EV-ready provisions in new builds and retrofit programs for social housing car parks.

- Support car-club fleets and community charging hubs to expand access without requiring ownership.

For industry (OEMs, dealers, charge-point operators)

- Design for universal access: physical reach, cable weight, UI contrast/voice control, and cashless/contactless parity.

- Offer battery-health certificates and extended warranties to stabilize the used market and protect lower-income buyers.

- Create community partnerships with colleges for apprenticeships; schedule pop-up clinics in estates and rural towns for test drives and EV literacy.

- Develop affordable trims with honest range, robust interiors, and heaters/defoggers optimized for UK winters.

- Publish service standards: fault fix within 48–72 hours, live support lines, and transparent uptime stats.

For civil society & employers

- Encourage salary-sacrifice schemes that include used EVs and fair-value options, not just premium models.

- Run driver-education on ADAS and safe charging etiquette; include materials for older drivers and multilingual communities.

- Use community energy groups to co-own charging assets and recycle revenues into local projects.

15) A simple “social impact scorecard” (ready to adopt)

Score each local area or project from 0–5 on:

- Coverage equity (proximity for renters/low-income wards)

- Accessibility (physical + digital)

- Affordability (monthly cost, insurance options, used-EV guarantees)

- Safety & dignity (lighting, CCTV, help lines, toilet access)

- Community voice (consultation, co-ownership, grievance redress)

- Jobs & skills (local training pathways, paid placements)

Aggregate scores guide where to invest next and how to improve service.

Technological Analysis of the UK Automobile Industry

Executive overview

UK automotive technology is pivoting from powertrain craftsmanship to software-defined, electrified, connected, and automated mobility. Competitive advantage will come from (1) localized battery value chains and power electronics, (2) world-class calibration, validation, and safety engineering, (3) manufacturing automation with real-time data, and (4) a robust charging and energy integration layer. The constraint is less invention than scale, cost, and time-to-industrialize.

1) R&D and innovation landscape

- Regional clusters: Advanced propulsion and battery research in the Midlands and North East; autonomous systems, sensors, and AI concentrated around leading universities and testbeds; specialist low-volume performance and motorsport engineering in the South and Midlands.

- Test & validation assets: Proving grounds with wet/grip surfaces, ADAS test routes, EMC chambers, battery abuse labs, and climate chambers are widely accessible through industry partnerships.

- Public–private programs: Collaborative projects typically target battery materials, recycling, power electronics, hydrogen for heavy duty, and connected/automated mobility (CAM) on designated corridors.

Takeaway: The UK’s edge is systems integration and validation rigour rather than sheer mass-production scale.

2) Electrified powertrains: state of the art

Battery-electric vehicles (BEV)

- Architectures: 400 V mass-market platforms; 800 V in premium/performance and vans for faster charging and copper weight reduction.

- Modules & packs: Transition from module-based to cell-to-pack or structural pack designs to reduce mass and parts count; liquid cooling with cold-plate or immersion pilots for thermal uniformity.

- Chemistries:

- LFP/LMFP for cost, cycle life, and cobalt-free supply; suited to small/mid EVs and vans.

- NMC for higher energy density in premium/long-range.

- Silicon-rich anodes in early commercialization; solid-state in advanced prototyping but not yet at fleet scale.

- e-Axles & motors: Move toward hairpin windings, oil-cooled stators, and rare-earth-lean or axial-flux pilots for packaging efficiency; integrated inverter/gearbox for NVH and cost.

Plug-in hybrids (PHEV)

- Still relevant for specific duty cycles; focus on serial–parallel blending logic, compact on-board chargers (OBCs), and seamless mode transitions to meet real-world emissions.

Hydrogen (H₂)

- Niche for heavy duty or long-range vans where payload and uptime dominate; stack durability (>20k hours), Type-IV tanks, and cold-start water management are the main engineering concerns.

Engineering priorities 2025–2030: cost-down of packs and e-drives, thermal robustness, low-temperature charge acceptance, and software-based range accuracy.

3) Power electronics and energy systems

- SiC inverters/DC-DC: Silicon carbide devices become standard in 800 V systems, delivering switching efficiency and smaller passive components; reliability (short-circuit withstand, gate-oxide) and supply security are watch-outs.

- On-board chargers (OBC): Bi-directional AC and DC V2X-ready designs (11–22 kW AC; 3–10 kW export) enable home back-up and grid services. Compliance with grid codes and anti-islanding is the gating factor.

- Thermal integration: Unified coolant loops for battery, e-motor, power electronics, and cabin heat pump; predictive control to balance cabin comfort vs range.

4) Software-defined vehicle (SDV)

- EE architectures: Migration from dozens of ECUs to domain and then zonal controllers linked by automotive Ethernet; reduces harness mass and simplifies OTA updates.

- Operating layer: Hypervisor-based separation of safety (ASIL) and non-safety functions; containerized services for infotainment, energy management, and fleet APIs.

- Feature roadmaps: Energy-aware routing, battery health estimation, torque-vectoring, ADAS feature packs, and paid software options (navigation, performance boosts) drive lifetime revenue.

- OTA & DevOps: Blue/green deployments, delta updates, and secure boot chains; telemetry pipelines feed fleet learning loops for range prediction and fault detection.

UK strength: calibration, model-based systems engineering, and functional-safety culture (ISO 26262/21434) embedded in suppliers and engineering consultancies.

5) ADAS and automated driving

- Sensor suites: Camera-centric L2/L2+ with radar fusion; emerging imaging radar for long-range resolution and solid-state lidar in premium trims or robotaxi pilots.

- Compute: Centralized SoCs with dedicated accelerators for perception and planning; power budgets constrained by EV efficiency targets.

- Mapping & localization: HD maps for highways and geo-fenced routes; UK pilots emphasize safety cases, fallback strategies, and human-machine interface (HMI) clarity.

- Validation: Scenario-based testing combining synthetic simulation, hardware-in-the-loop (HIL), and shadow-mode fleet data; emphasis on explainability and misuse resilience.

Focus areas: low-speed urban automation, motorway assist, automated parking, and driver monitoring to manage liability and misuse.

6) Connectivity, data, and cybersecurity

- Telematics: eSIM/5G SA with fallback to LTE; MQTT/HTTP streaming to cloud; payloads include battery metrics, fault codes, location, and anonymized usage.

- Edge analytics: On-vehicle anomaly detection to reduce uplink; compression and event-driven telemetry to cut data costs.

- APIs & ecosystems: Energy partners (smart tariffs), insurers (usage-based), fleets (utilization), retailers (commerce), and municipalities (charging/parking integration).

- Cybersecurity: End-to-end PKI, HSM-backed keys, secure diagnostics, SBOM management, intrusion detection on CAN/Ethernet, and lifecycle patching processes aligned to road-vehicle cyber standards.

7) Charging technologies and grid integration

- Public rapid DC: 150–350 kW multi-standard chargers with liquid-cooled cables; high-uptime designs use modular rectifier stacks and remote diagnostics.

- AC destination & on-street: 7–22 kW with load balancing; lamp-column retrofits and curbside pedestals address renters; cable-management for accessibility.

- Depot solutions: Load-shaped charging, peak-shaving batteries, and solar canopies; OCPP-compliant back-ends for fleet orchestration.

- Vehicle-to-Grid (V2G/V2H): Early commercial deployments where tariff arbitrage and flexibility markets exist; requires bi-directional OBC or DC converters and customer-friendly warranties on cycling.

- Payment & UX: Tap-to-pay readers, roaming, price transparency per kWh/minute, and real-time status in apps and nav systems reduce friction.

8) Manufacturing and Industry 4.0

- Body & paint: Servo presses with in-die sensing; aluminium and multi-material joining (Rivet-Bond, FSW, laser welding); low-energy ovens and smart curing cycles.

- Battery lines: Dry-room environments, high-precision coating & calendering, advanced formation cycling, and inline X-ray/laser metrology for defect detection.

- e-Drive assembly: Automated rotor insertion, stator hairpin forming, and end-of-line NVH/electrical testing; traceability via RFID/QR from component to vehicle.

- Digital twin: Process twins for stamping/paint, pack-line simulation for throughput, and anomaly detection with vision AI; closed-loop SPC for quality drift.

- Sustainability by design: Water recycling in paint, solvent recovery, and low-GWP refrigerants; energy dashboards aligned to corporate carbon targets.

9) Materials, light-weighting, and circularity

- Materials: Mixed-material bodies (aluminium, UHSS, composites); cast “megacell” front/rear structures under evaluation; attention to repairability and insurance cost.

- Battery recycling & second life: Hydrometallurgical/pyrometallurgical pathways to recover Li, Ni, Co; module triage for stationary storage; digital battery passports to support provenance and reuse.

- Design for disassembly: Fasteners, adhesive choices, and component marking to speed recycling and reduce total lifecycle cost.

10) Testing, safety, and compliance

- Functional safety & SOTIF: Hazard analysis, ASIL targeting, and safety cases for perception limitations (weather, occlusions).

- EMC & high-voltage safety: Shielding for high-frequency switching, creepage/clearance, and safe service procedures.

- Battery safety: Nail penetration, thermal runaway containment, venting paths, off-gas sensing, and post-crash isolation; winter charging validation is critical in the UK climate.

11) Workforce and skills

- New skill mix: High-voltage safety, BMS algorithms, SiC power electronics, embedded Linux, AUTOSAR Adaptive, Ethernet diagnostics, OTA security, and AI for perception.

- Retraining pathways: Conversion programs for ICE technicians to EV service; IPC/SMT qualifications for electronics; battery manufacturing operator training with quality culture.

12) Technology KPIs (lead/lag indicators)

- Battery: pack cost (£/kWh), energy density (Wh/kg), cold-charge C-rate, cycle life at 80% EoL, yield %, scrap %.

- e-Drive: peak efficiency %, copper/rare-earth mass per kW, inverter switching losses, NVH (dB).

- Vehicle: WLTP/real-world range delta (%), heat-pump COP at 0 °C, OTA update success rate (%), software defect escape rate (ppm).

- ADAS: disengagements per 1,000 km (by scenario), perception precision/recall for vulnerable road users, DMS compliance rate.

- Manufacturing: OEE %, first-pass yield %, cycle time (s), energy per vehicle (kWh), CO₂e per vehicle (kg).

- Charging: site uptime %, average queue time (min), effective power delivered (kW vs rated), accessibility compliance rate (%).

13) Risks and constraints

- Battery supply & cost volatility (chemistry shifts, commodity cycles).

- SiC device availability and long lead times.

- Software complexity outpacing test capacity; OTA failures erode trust.

- Cybersecurity liabilities and regulatory penalties.

- Grid connection delays for depots and hubs.

- Insurance/repair costs for mixed-material bodies and sensor-laden bumpers.

14) Strategic recommendations

For manufacturers (OEMs)

- Platform standardization: converge on a small set of 400/800 V skateboards with shared e-axles and inverters; design for manufacturability and repair.

- Battery strategy: dual-chemistry roadmap (LFP/LMFP + NMC); invest in pack structural integration and cold-weather charge performance; secure recycling offtake.

- SDV foundation: zonal architecture, strong middleware, strict interface contracts; invest in fleet learning pipelines and shadow-mode validation.

- Safety & cyber: treat ISO safety and cyber processes as product features; publish update SLAs and security transparency.

- Cost & energy: PPAs/on-site generation; SiC adoption with second-source strategies; aggressive automation where utilization justifies.

For suppliers

- Move up the value chain in power electronics, thermal, sensors, and software; provide validated subsystems not just parts.

- Metrology & yield excellence on battery and SiC components; offer predictive quality as a service.

- Design for accessibility/repair to reduce insurer pushback and keep premiums in check.

For charge-point and energy partners

- Engineer for uptime: modular rectifiers, hot-swap, remote triage.

- Accessibility-first sites: cable management, lighting, contactless pay, and clear kerb design.

- Smart integration: V2H/V2B pilots with transparent warranties; tariff bundles integrated into in-car UX.

15) 24-month technology roadmap (pragmatic)

- 0–6 months: finalize zonal EE architecture; SiC inverter sourcing; battery winter-charge improvement plan; OTA pipeline hardening; charger uptime telemetry.

- 6–12 months: launch LFP variant on mid-range model; roll out energy-aware routing; deploy depot charging with load management; begin ADAS shadow-mode data collection.

- 12–18 months: structural pack pilot; bi-directional OBC option; imaging-radar or lidar on premium trims; digital twin for pack and e-drive lines.

- 18–24 months: second-life battery partnerships; automated defect detection at scale; fleet-grade V2H trials; subscription software bundles tied to energy services.

Environmental Analysis of the UK Automobile Industry

Executive overview

The UK auto sector’s environmental footprint is dominated by two phases: vehicle use (tailpipe and electricity-related emissions, road/tyre particulates, noise) and manufacturing/supply chains (battery materials, metals, plastics, energy, and water). Electrification reduces urban air pollution and use-phase CO₂, but front-loaded manufacturing impacts—especially batteries—grow in relative importance. The winners will (1) localize low-carbon supply chains, (2) secure clean power for plants and chargers, (3) design for repair and circularity, and (4) make charging accessible so benefits reach all communities.

1) Lifecycle view (from mine to motor)

Think in four blocks:

- Raw materials & processing

- Steel, aluminium, copper, polymers, glass, electronics, and battery minerals (lithium, nickel, manganese, cobalt, graphite).

- High energy intensity and potential land, water, and biodiversity impacts at extraction.

- Manufacturing & logistics

- Body/paint shops (heat, solvents), battery and e-drive lines (dry rooms, precision climate control), inbound logistics.

- Scope 1–2 emissions are driven by gas for heat and electricity for presses, ovens, and formation cycling.

- Use phase

- ICE: tailpipe NOx/CO₂/PM plus upstream fuel emissions.

- BEV/PHEV: zero tailpipe; total footprint varies with grid mix and charging behavior; tyre and brake particulates persist.

- End-of-life & circularity

- Reuse, remanufacture, recycling of metals; battery triage (second-life vs recycling); safe handling of hazardous fractions.

Implication: As the grid decarbonizes, the manufacturing and materials share of a BEV’s total footprint becomes decisive. Procurement and product design carry as much environmental leverage as powertrain choice.

2) Carbon: Scopes 1–3 and priority levers

Scope 1 (direct)

- Paint ovens, space heating, onsite fleets.

- Levers: electrify heat (where feasible), recover waste heat, switch to low-carbon fuels for high-temp processes, and improve oven cure cycles.

Scope 2 (purchased electricity)

- Plant operations and data centres.

- Levers: long-term renewable PPAs, rooftop/adjacent solar, load-shifting to off-peak low-carbon periods, real-time energy management.

Scope 3 (value chain—dominant share)

- Upstream: metals, polymers, battery cells/cathodes, inbound logistics.

- Downstream: fuel/electricity for use phase, service parts, end-of-life.

- Levers: green steel/aluminium sourcing, recycled content targets, battery chemistry choice (LFP/LMFP vs high-nickel), recycled cathode material, efficient logistics, dealer energy standards, and certified recycling of batteries and rare materials.

3) Air quality, particulates, and noise

- Urban air quality: BEVs cut tailpipe NOx and hydrocarbons, improving local air.

- Non-exhaust PM: Tyre and road wear particles persist for all drivetrains; mass and driving style matter. Regenerative braking reduces brake dust.

- Noise: EVs are quieter at low speeds; at higher speeds, tyre/road noise dominates. Acoustic design (tyres, wheel wells) and AVAS compliance shape real-world outcomes.

4) Materials and chemistry hotspots

Metals

- Steel: Major embodied emissions; green steel (electric arc + high recycled content or DRI with low-carbon hydrogen) shifts the needle.

- Aluminium: Lightweighting benefits are offset by energy-intensive smelting unless recycled or low-carbon sourced.

Batteries

- Chemistry:

- LFP/LMFP: Lower critical-metal intensity, strong cycle life—good for mass-market and vans.

- NMC/NCA: Higher energy density for premium/long-range; environmental burden hinges on nickel/cobalt supply and recycling rates.

- Design: Cell-to-pack or structural packs reduce parts and mass. Robust thermal management protects cycle life and safety, lowering lifetime impacts.

- Recycling: Hydrometallurgical recovery of Li/Ni/Co/Mn and graphite reclamation reduce upstream demand; battery passports enable traceability.

Polymers & interiors

- Recycled content, bio-based polymers, solvent-free adhesives/paints, and VOC controls improve worker and user environments.

5) Water, solvents, and waste

- Water stress: Paint shops and battery formation consume significant water; closed-loop systems and rainwater harvesting mitigate.

- Solvents & VOCs: Shift to waterborne coatings and thermal oxidizers with heat recovery.

- Solid waste: Metal scrap recycling is mature; focus on battery scrap, composite offcuts, and electronics (WEEE) with verified downstream handlers.

6) Land use, biodiversity, and community footprint

- Sites & logistics parks: Preserve and enhance green corridors, ponds, and pollinator habitats; integrate sustainable drainage systems (SuDS).

- Supply chain extraction: Prioritize suppliers with responsible mining, community consent, and rehabilitation plans.

- Charging hubs: Site design should protect trees, manage lighting to reduce ecological disturbance, and include permeable surfaces.

7) Energy & charging ecosystem

Grid and chargers

- Public rapid DC: High load factors demand careful grid planning; colocated batteries smooth peaks.

- On-street & destination AC: Load-balancing, timed tariffs, and smart charging spread demand.

- Depots: Solar canopies, stationary storage, and integrated energy management shrink Scope 2/3.

Vehicle-to-X

- V2H/V2B/V2G: When customer-friendly and warranty-clear, bidirectional capability displaces fossil backup and supports renewables integration—creating system-level emissions reductions beyond the vehicle boundary.

8) Circularity strategy (design, use, recovery)

- Design for life extension: modular components, standardized fasteners, accessible battery modules (where safe), replaceable glass and fascia to cut write-offs.

- Repairability & insurance: publish repair procedures; design sensor placement to avoid total-loss from minor bumps; choose materials that are mendable.

- Re-use and reman: motors, inverters, gearsets, infotainment, and seats can be remanufactured with warranty.

- Battery second life: triage to stationary storage before recycling; guarantee minimum state-of-health at hand-over.

- High-yield recycling: secure take-back; ensure UK/EU processors with high recovery rates and audited environmental controls.

9) Key environmental KPIs and targets (practical dashboard)

Track at model, plant, and corporate levels:

- Carbon

- gCO₂e/km WLTP & real-world (by segment)

- Vehicle embodied CO₂e at SOP (kg/vehicle) and trend

- Share of renewable electricity (%) at plants and DC charging

- Materials & circularity

- Recycled aluminium/steel content (%)

- Recycled/biobased polymer share (%)

- Battery recycled content (%) and collection rate (%)

- End-of-life recovery rate (%) and landfill diversion (%)

- Water & solvents

- Water intensity (litres/vehicle) and % closed-loop

- VOC emissions (g/m² coated)

- Air & particulates

- Non-exhaust PM index (tyre/brake) per vehicle class

- Noise measurements (dB) at urban speeds

- Biodiversity & land

- Net habitat units (baseline vs post-development)

- Green cover and SuDS capacity on sites

- Charging & energy integration

- Charger uptime (%) and average carbon intensity (gCO₂/kWh) delivered

- Share of smart/managed charging sessions (%)

- V2X-enabled vehicles as % of fleet

10) Risk map (2025–2030)

- Materials transition risk: Delays in low-carbon steel/aluminium supply raise embodied emissions and miss targets.

- Battery sustainability scrutiny: Social and ecological concerns at mines; regulatory pressure for due diligence and recycling.

- Energy price/availability: High-carbon electricity undermines BEV advantages if charging is unmanaged.

- Insurance & repairability: High write-off rates for sensor-dense bumpers and bonded structures waste embodied carbon.

- Wastewater & VOC compliance: Tightening permits and community expectations.

- Reputational risk: Green claims without measurable progress (“greenhushing” or “greenwashing”) erode trust.

11) Segment-specific insights

- Small/mid BEVs: Lowest use-phase emissions; priority is affordable packs, durable interiors, and accessible charging; great candidates for high recycled-content targets.

- Premium/long-range BEVs: Higher embodied emissions; must pair with verified low-carbon materials and high-renewables charging partnerships.

- LCVs (vans): Depot charging and route optimization unlock large CO₂ and air-quality gains; payload/range trade-offs need honest specs.

- Performance & niche vehicles: Low volumes but high visibility—ideal for material innovation pilots (recycled carbon fibre, bio-composites).

12) Practical playbook

For manufacturers (OEMs)

- Embodied-carbon budgets per vehicle platform; gate design choices with a carbon bill-of-materials.

- Dual-chemistry battery roadmap (e.g., LFP for mass, NMC for range) with recycled cathode content targets.

- Green metals sourcing with supplier scorecards; commit to recycled aluminium and low-carbon steel percentages.

- Repairability by design: sacrificial crash structures, sensor modules on replaceable brackets, standardized glazing and lamps.

- Energy strategy: renewable PPAs for plants; integrate charging network partners that disclose real-time carbon intensity and uptime.

- Battery lifecycle: contract second-life partners; guarantee take-back; share diagnostic data to reduce unnecessary replacements.

For suppliers

- Process decarbonization: electrify heat where possible; recover waste heat; certify electricity origin; publish product EPDs.

- Material innovation: recycled polymers with stable color/odor; coatings with low cure temps; adhesives enabling future disassembly.

- Closed-loop scrap with OEMs—especially aluminium and copper.

For charge-point operators and energy partners

- Uptime + transparency: public dashboards for availability and repair times; display price and estimated carbon intensity per session.

- Smart charging defaults: off-peak incentives; depot load management; simple user consent for carbon-aware charging.

- Site design: permeable paving, tree protection, wildlife-friendly lighting, accessible bays, safe cable management.

For fleets & retailers

- Carbon-aware routing and charging baked into telematics; driver training on eco-driving and tyre pressures.

- Used-EV confidence: battery-health certificates, fair warranties, and end-of-life pathways explained at sale.

- Servicing: clean-fluid handling, tyre selection for low abrasion, brake-pad materials tuned for low PM.

13) Governance, reporting, and culture

- Targets that matter: absolute Scope 1–3 reductions with interim milestones, not just intensity metrics.

- Data discipline: product-level LCAs, supplier primary data, and digital traceability (battery passports, recycled content proofs).

- Incentives & training: link leadership bonuses and plant KPIs to carbon, water, and waste goals; train engineers on eco-design and procurement on low-carbon contracts.

- Customer transparency: publish repairability scores, recycled content, and realistic range/charging performance—trust is a climate tool.

14) 24-month roadmap (sequenced actions)

18–24 months: second-life battery projects at depots; scale closed-loop aluminium; roll out biodiversity net-gain plans at major sites; verify Scope 3 cuts via supplier data.

0–6 months: set embodied-carbon targets; sign renewable PPAs; start green-steel/aluminium supplier audits; add repairability constraints to new programs.

6–12 months: pilot recycled-content interiors; implement carbon-aware smart charging with one CPO partner; launch battery take-back contracts; deploy tyre/PM monitoring on a fleet.

12–18 months: ramp low-temperature paint processes; introduce LFP variant in a high-volume model; live dashboard for plant water/VOC; publish product EPDs.

Legal Factors Analysis of the UK Automobile Industry

Executive overview

Automotive businesses in the UK operate under a dense, fast-evolving legal framework. The biggest pressure points are: (1) product safety and type-approval obligations for electrified, software-defined vehicles; (2) data protection and cybersecurity duties for connected/telematics features; (3) consumer-protection and advertising rules, with heightened scrutiny of environmental claims and finance practices; (4) competition and distribution law for agency models and vertical pricing; (5) environmental producer-responsibility regimes for batteries, WEEE, and end-of-life vehicles; and (6) the maturing regime for automated driving and over-the-air (OTA) updates. Strong governance, documented safety cases, and transparent consumer communications are now core risk controls.

1) Product safety, liability, and recall

Core concepts

- General product safety and sector-specific vehicle rules apply in parallel. Vehicles, components, and accessories must be safe when placed on the market, with risk assessments and technical files maintained.

- Strict liability for defective products applies to manufacturers, importers, and (in some cases) own-branders. Retailers can be drawn in if upstream parties cannot be identified.

- Duty to monitor: manufacturers and distributors must track in-service performance, incident reports, and field data, triggering corrective actions where needed.

Recall and corrective actions

- Risk-based response: from customer notices and software patches to formal recalls coordinated with authorities. EVs and connected cars add software recalls/OTA campaigns to traditional mechanical fixes.

- Documentation: hazard analysis, decision logs, remedy effectiveness checks, customer notification evidence, and completion rates.

Practical controls

- Safety governance board; single owner for field actions; harmonised defect-classification criteria; secure OTA pipelines; legal review of release notes; and post-fix monitoring.

2) Type approval, conformity, and markings

GB type approval

- UK has a GB type-approval system (administered domestically) alongside recognition routes for certain foreign approvals in defined circumstances. Components (e.g., lighting, braking, tyres) and whole vehicles require conformity assessments.

- Conformity of Production (CoP): robust quality systems, traceability, and periodic audits; failures can ground vehicles or halt registrations.

Marking and documentation

- Marking/label requirements for parts and vehicles, VIN integrity, and owner documentation (including EV battery and charging specifications).

- Post-approval change control: engineering changes, software updates, and supplier switches often trigger re-approval or notification duties.

3) Vehicle construction, use, and road-traffic law

- Construction and Use requirements govern dimensions, weights, tyres, lighting, emissions/OBD, noise, safety devices, and (for EVs) acoustic vehicle alerts.

- Road Traffic law assigns responsibilities for driver licensing, insurance, and roadworthiness. For assisted/automated features, human-machine interface, driver monitoring, and safe-use conditions must be crystal clear in manuals and UX.

4) Connected cars, data protection, and cybersecurity

Data protection

- UK data-protection law applies to vehicle telemetry, location data, driver profiles, voice assistants, camera sensors, and in-car commerce. Key duties:

- Lawful basis and purpose limitation for each data stream.

- Transparency: concise privacy notices in-vehicle and in apps; layered, readable, and accessible.

- Consent where required (e.g., certain categories of tracking/marketing).

- Data minimisation and retention aligned to safety, warranty, and regulatory needs.

- International transfers: appropriate safeguards for off-shoring analytics or support.

Cybersecurity

- Security by design across the vehicle lifecycle: secure boot, signed firmware, key management (HSM), intrusion detection on CAN/Ethernet, and incident response procedures.

- Over-the-air updates: strong authentication, rollback plans, staged releases, and safety/regulatory impact assessments before deployment.

Ownership and access

- Clarify data controllership among OEMs, dealers, finance firms, and third-party app providers; define driver/owner access to vehicle data and battery health reports; and govern insurer/repairer access via APIs with appropriate safeguards.

5) Consumer law, sales models, and advertising

Consumer rights

- Clear terms on delivery, conformity, refunds/repairs, and software functionality. For SDVs, define what is “included” at purchase vs subscription features. Misleading omissions about range, charging speed, or battery degradation invite enforcement and private claims.

Finance and affordability

- Consumer-credit and motor-finance rules cover affordability checks, disclosures, commission transparency, arrears handling, and complaint outcomes. Dealer and broker incentives must avoid conflicts; record-keeping is critical.

Green claims and performance claims

- Environmental and efficiency statements (e.g., “zero emissions,” “net-zero,” “recyclable”) must be truthful, specific, and substantiated. Charging-time and range claims should reflect realistic conditions and state caveats plainly (temperature, charger power, payload).

Distance selling and digital journeys

- Online reservations, cancellations, deposits, and click-through terms must comply with distance-selling obligations (pre-contract information, withdrawal rights where applicable).

6) Competition law, distribution, and aftersales

Distribution models

- Shift to agency and hybrid models raises questions on pricing controls, dual roles, and data access. Resale price maintenance, selective distribution criteria, and information exchange with independent dealers require careful design.

Aftermarket and repair

- Motor-vehicle competition exemptions (national regime) support access to technical information, tools, and spare parts for independent repairers. Blocking access or tying diagnostics to captive networks risks enforcement.

Warranties and servicing

- Clauses suggesting warranty loss for independent servicing can be unfair. Publish repair procedures and reasonable parts policies to avoid exclusionary effects.

7) Environmental and product-responsibility law

Producer responsibility

- End-of-Life Vehicles (ELV): targets for reuse, recycling, and recovery; free take-back for last owners; hazardous-fluid and airbag handling rules.

- Batteries & accumulators: collection, treatment, and material-recovery duties; labelling and information for safe removal; tracking of EV batteries through life.

- WEEE (electronics): applies to in-car screens/infotainment and service parts in some contexts.

Chemicals and materials

- Substance restrictions and reporting for components (plastics, seat foams, wiring, adhesives, thermal fluids). Maintain supplier declarations, testing evidence, and change-control logs.

Waste, water, and air

- Permits and controls for paint/solvent emissions, wastewater, and waste management at plants and dealer workshops; tyre and brake-dust considerations in urban compliance initiatives.

8) Employment, health & safety, and skills

Workforce transitions

- Electrification alters skill demand; consultation and fair-selection rules apply to restructurings. TUPE can be triggered in outsourcing/insourcing scenarios.

H&S duties

- High-voltage safety for EV assembly/service; lock-out/tag-out; battery fire protocols; thermal-runaway response; PPE and training records. Robotics and AGV safety in plants require robust risk assessments and guarding.

Apprenticeships and training

- Documented training for EV technicians, HV permits, and battery handling; keep competence matrices to defend against enforcement or civil claims.

9) Public procurement and fleet rules

- Public contracts increasingly require sustainability, accessibility, and social-value criteria. Bidders must evidence carbon plans, ethical sourcing, accessibility of charging, and fair-work practices. Contract flow-downs extend obligations to Tier-1/2 suppliers.

10) Import/export, customs, and trade compliance

Rules of origin

- Tariff outcomes depend on local content thresholds, especially for batteries and key components. Maintain supplier declarations and BOM traceability to substantiate origin.

Sanctions and export controls

- Dual-use controls can apply to advanced sensors, encryption, or autonomous-driving compute. Screen customers and end-uses; keep red-flag escalation paths.

Marking and documentation at the border

- Accurate commodity codes, valuation, and preferential-origin claims; ensure conformity documents are ready for inspection.

11) Intellectual property, software, and standards

Patents and trade secrets

- Protect e-motors, power electronics, BMS algorithms, and thermal designs; govern joint-development IP with suppliers and universities. Keep trade-secret hygiene (access controls, clean-room notes).

Standards and licensing

- Standard-essential patents (SEPs) for connectivity and codecs: implement FRAND strategies, patent pools where sensible, and early clearance for infotainment stacks.

Open-source compliance

- SBOMs, license scanning, notice files, and reproducible builds—especially for infotainment and middleware—to avoid breach of license terms.

12) Automated and connected driving law

Authorisation and liability

- The UK is formalising a self-driving vehicle regime with defined roles (e.g., user-in-charge vs no-user-in-charge), safety cases, and operator accountability. Expect obligations on incident reporting, remote operations, and minimum performance for automated features.

ADS safety case

- Scenario coverage, HMI clarity, driver monitoring where needed, cybersecurity and software update safety, and roadside-assistance protocols. Marketing must match the authorised operational design domain (ODD).

Insurance and investigation

- Data storage and event recorders to enable crash investigation and liability allocation; defined data-sharing with insurers and authorities.

13) Accessibility, equality, and consumer inclusion

Equality duties

- Charging sites and dealer facilities must be accessible: bay width, kerb heights, cable reach/weight, lighting, signage, and staff training. Vehicle adaptations and Motability processes require fair treatment and prompt repairs.

Digital inclusion

- Avoid app-only barriers: provide contactless payment, helplines, and multi-language support; ensure HMI contrast/voice control for drivers with impairments.

14) Governance, documentation, and culture (what “good” looks like)

- Legal register & owner mapping for each regime (product, data, finance, environment, competition).

- Change-control: legal “gates” for software, parts, suppliers, and features that may trigger type-approval or consumer-law updates.

- Safety case & OTA logbook: cross-functional approvals, rollback plans, and post-release monitoring.

- Complaints & redress: fast pathways for safety and finance complaints; root-cause tracking; learnings shared.

- Dealer governance: audit packs covering finance disclosures, advertising, test-drive safety, personal-data handling, and accessibility.

- Supplier contracts: warranties, compliance clauses, audit rights, data-sharing, cybersecurity, and recall cost-sharing.

15) Top legal risks (2025–2028) and mitigations

- Misleading green/performance claims → Pre-clear copy; substantiate range/charging statements; standard disclaimers.

- Software/OTA safety incident → Safety impact assessment; staged rollout; rapid rollback; incident drill practice.

- Data/cyber breach → DPIAs, least-privilege access, HSM key storage, patch SLAs, tabletop exercises.

- Motor-finance conduct failures → Commission transparency, affordability checks, quality file audits, clear customer journeys.

- Distribution/competition issues → Counsel-reviewed agency contracts; pricing freedom boundaries; fair access to repair data.

- Producer-responsibility non-compliance → Take-back logistics, recycling partners, battery tracking and reporting.

- Type-approval gaps after changes → Legal gate in engineering release process; regulator engagement plan.

- Autonomous feature misuse → Robust HMI, driver monitoring (where applicable), ODD geofencing, conservative marketing.

16) 12-month legal roadmap (practical, sequenced)

Quarter 1

- Gap-analysis across product safety, data, finance, environment, competition, AV.

- Appoint single points of accountability for recalls, OTA compliance, and battery EPR.

- Build legal “change-gate” into engineering and software release workflows.

Quarter 2

- Refresh consumer journey: finance disclosures, cancellation rights, green-claims substantiation, and accessibility (web and physical).

- Supplier re-papering: cybersecurity clauses, data-sharing, origin declarations, recall cost-sharing.

Quarter 3

- Conduct DPIAs and cyber threat modelling for connected features; test incident response and regulatory notification drill.

- Launch independent-repairer access portal with audited documentation and fair pricing for tools.

Quarter 4

- Full recall simulation (mechanical + OTA).

- Producer-responsibility audit (batteries/ELV/WEEE) and public KPI dashboard.

- AV readiness review: safety case template, ODD governance, and marketing guardrails.

17) Board KPIs and evidence pack

- Product: open field actions; recall completion rate; time-to-containment (days); OTA success/rollback rates.

- Data/cyber: DPIA coverage; time-to-patch; pen-test findings closed; security incidents (sev-rated).

- Consumer: upheld complaints rate; average redress time; finance QA pass-rate; mystery-shopper scores.

- Environment: ELV recovery %, battery collection %, verified recycled content.

- Competition/aftermarket: repair-info portal uptime; access requests fulfilled; dealer audit pass-rate.

- AV/ADAS: safety-case updates; ODD compliance incidents; DMS alerts vs disengagements.

Conclusion

The UK automobile industry stands at a turning point where policy ambition, economic realities, consumer trust, technological capability, environmental sustainability, and legal compliance converge.

- Politically, government policy is ambitious but demands alignment with EU and global partners.

- Economically, competitiveness hinges on managing costs, scaling battery capacity, and stimulating consumer demand.

- Socially, inclusivity, affordability, and regional equity are essential for a “just transition.”

- Technologically, success depends on industrializing innovation in batteries, software, and automation.

- Environmentally, lifecycle sustainability—not just zero tailpipe emissions—defines credibility.

- Legally, evolving safety, data, and producer-responsibility frameworks require disciplined governance.

Overall, the industry’s long-term resilience depends on how effectively it balances rapid technological change with affordability, fairness, and sustainability while navigating a demanding legal and regulatory landscape.

Would you like me to now create a PESTEL summary matrix table (one row per factor with drivers, risks, and opportunities) so you have a quick reference snapshot alongside this narrative?